那些刚攒够了首付、准备第一次买房的人,可能很难跟那些已经有不少房产积蓄的资深房主们竞争。而且随着生活成本上涨,首次购房的新手很可能就被挤出比较贵价的区域。

SmartAsset研究了185个都市区的房地产市场现状,找出了首次买房者能买到划算房子的最佳地点。这些地方的排名是根据房价是否能负担得起、竞争激烈程度和每个房市的社区特色等因素来定的。

最适合首次购房新手的房市

划重点:

- Lawton, OK是最适合首次买房的地方。劳顿的房价在全美排名第五便宜,家庭收入中位数($55,148)占房价中位数($131,150)的44.3%。同时,25至39岁的人口占24%,在全美排名第六。房屋竞争程度一般,房源挂牌到签约大约需要22天。但房价预计在未来一年内仅上涨0.9%,略低于平均预测的1.6%。

- Peoria, IL都市区拥有最实惠的住房市场。相对于$68,249的中位收入,房屋的平均中位价格为$121,333,相当便宜。这个单一指标使得Peoria在首次购房者最佳房市排名中位列第七。

- Bloomington, IL都市区的房市竞争最激烈。Bloomington房屋平均只挂牌4天就会签约,这意味着首次购房者需要做好抢购的准备。这部分是由于相对人口来说住房库存特别低,再加上房价($197,067)相对于中等家庭收入($70,674)来说还算合理。

- 佛罗里达的这些都市区房屋库存最高。相对于人口数量,最多房源出售的前10个城市中有一半都在佛罗里达,其中包括Cape Coral(总体排名第二)、Port St. Lucie, Lakeland, Tampa和Jacksonville。这些都市区的房价预计在明年上涨幅度普遍高于平均水平,增幅为2.3%至3.6%,而且购房者购房者在房源挂牌到签约平均大概有一个月的时间。

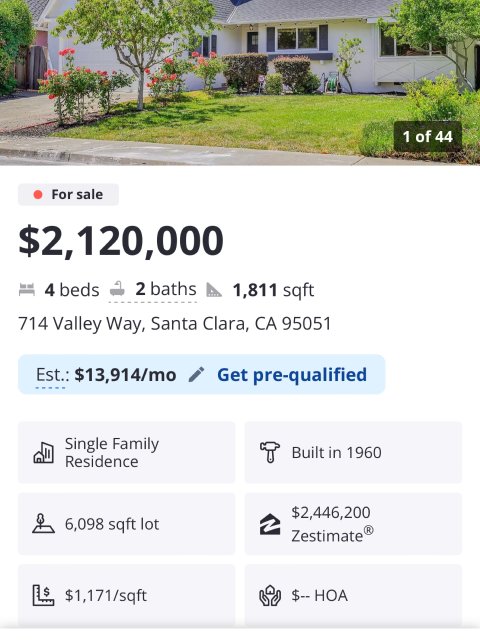

- 加州的这些都市区房市房价最贵。根据该地区家庭收入中位数来看房屋销售价格中位数时,加州大都会区占据了十个全美最昂贵房市中的六个席位。收入只占房价的10%到13%的地方包括洛杉矶(中位房价$886,667)、Santa Maria($852,250)、圣何塞($1,386,667)、Salinas($821,000)、Napa($875,000)和Oxnard($812,417)。

| 最适合首次购房新手的地区排名 | ||||

|---|---|---|---|---|

| 排名 | 城市 | 房价中位数 2024年2月 | 挂牌天数 | Zillow一年涨幅预测 |

| 1 | Lawton, OK | $131,150 | 22 | 0.9% |

| 2 | Cape Coral-Fort Myers, FL | $291,667 | 43 | 2.7% |

| 3 | Clarksville, TN-KY | $268,967 | 28 | 3.7% |

| 4 | McAllen-Edinburg-Mission, TX | $192,867 | 53 | 3.9% |

| 5 | Killeen-Temple, TX | $249,538 | 36 | 2.2% |

| 6 | Wichita Falls, TX | $171,598 | 37 | 2.3% |

| 7 | Peoria, IL | $121,333 | 13 | 0.5% |

| 8 | Appleton, WI | $268,633 | 40 | 2.6% |

| 9 | Memphis, TN-MS-AR | $204,000 | 30 | 2.4% |

| 10 | Fayetteville, NC | $218,500 | 14 | 3.9% |

| 11 | Rockford, IL | $159,000 | 10 | 3.6% |

| 12 | Tyler, TX | $282,967 | 48 | 2.5% |

| 13 | Rochester, NY | $199,975 | 8 | 5.0% |

| 14 | Jacksonville, NC | $238,333 | 15 | 2.9% |

| 15 | Waco, TX | $253,614 | 45 | 2.3% |

| 16 | Green Bay, WI | $266,750 | 40 | 3.2% |

| 17 | Huntsville, AL | $284,311 | 27 | 3.2% |

| 18 | Savannah, GA | $314,148 | 26 | 3.6% |

| 19 | Jacksonville, FL | $329,667 | 37 | 2.3% |

| 20 | Jackson, TN | $183,167 | 25 | 4.2% |

| 21 | Youngstown-Warren-Boardman, OH-PA | $131,333 | 16 | 3.1% |

| 22 | Eau Claire, WI | $261,467 | 31 | 2.9% |

| 23 | El Paso, TX | $227,667 | 29 | 2.9% |

| 24 | Brownsville-Harlingen, TX | $214,159 | 43 | 3.6% |

| 25 | Mobile, AL | $185,983 | 33 | 2.1% |

| 26 | Pueblo, CO | $273,300 | 46 | 1.6% |

| 27 | Jonesboro, AR | $181,233 | 37 | 0.2% |

| 28 | Columbus, GA-AL | $179,967 | 14 | 2.2% |

| 29 | Odessa, TX | $258,417 | 47 | -2.2% |

| 30 | Victoria, TX | $248,067 | 57 | 0.1% |

| 31 | Sioux City, IA-NE-SD | $181,500 | 22 | 1.1% |

| 32 | Syracuse, NY | $193,667 | 7 | 4.5% |

| 33 | Muncie, IN | $137,377 | 14 | 3.9% |

| 34 | Toledo, OH | $140,000 | 10 | 1.3% |

| 35 | Canton-Massillon, OH | $156,250 | 12 | 2.0% |

| 36 | Fort Wayne, IN | $217,233 | 10 | 3.6% |

| 37 | Flint, MI | $163,917 | 18 | 2.5% |

| 38 | Tulsa, OK | $215,583 | 23 | 2.2% |

| 39 | Indianapolis-Carmel-Anderson, IN | $250,333 | 15 | 2.5% |

| 40 | Lakeland-Winter Haven, FL | $297,600 | 34 | 2.9% |

| 41 | South Bend-Mishawaka, IN-MI | $178,000 | 18 | 2.8% |

| 42 | San Antonio-New Braunfels, TX | $297,500 | 45 | -0.2% |

| 43 | Tampa-St. Petersburg-Clearwater, FL | $356,667 | 29 | 3.6% |

| 44 | Longview, TX | $229,583 | 46 | 0.0% |

| 45 | Oklahoma City, OK | $218,500 | 21 | 1.3% |

| 46 | Akron, OH | $167,167 | 8 | 2.0% |

| 47 | Knoxville, TN | $321,000 | 14 | 6.1% |

| 48 | Abilene, TX | $222,900 | 34 | 0.1% |

| 49 | Montgomery, AL | $165,833 | 17 | 0.1% |

| 50 | Decatur, IL | $128,500 | 11 | 0.7% |

| 51 | Augusta-Richmond County, GA-SC | $213,983 | 19 | 2.3% |

| 52 | Des Moines-West Des Moines, IA | $241,333 | 23 | -0.1% |

| 53 | Orlando-Kissimmee-Sanford, FL | $323,000 | 34 | 2.2% |

| 54 | Cleveland-Elyria, OH | $170,667 | 10 | 2.0% |

| 55 | Columbus, OH | $259,170 | 6 | 3.0% |

| 56 | Fort Smith, AR-OK | $173,560 | 31 | 1.3% |

| 57 | Chattanooga, TN-GA | $279,967 | 18 | 3.4% |

| 58 | Charlotte-Concord-Gastonia, NC-SC | $348,667 | 14 | 4.0% |

| 59 | Lubbock, TX | $215,167 | 30 | 0.6% |

| 60 | Nashville-Davidson--Murfreesboro--Franklin, TN | $411,783 | 25 | 2.5% |

| 61 | Amarillo, TX | $225,417 | 30 | 1.0% |

| 62 | Warner Robins, GA | $218,833 | 13 | 2.3% |

| 63 | Erie, PA | $154,583 | 9 | 2.4% |

| 64 | Columbia, SC | $224,967 | 16 | 2.9% |

| 65 | Orlando-Kissimmee-Sanford, FL | $373,280 | 27 | 2.4% |

| 66 | Port St. Lucie, FL | $365,000 | 37 | 3.5% |

| 67 | Lansing-East Lansing, MI | $179,222 | 10 | 1.7% |

| 68 | Little Rock-North Little Rock-Conway, AR | $200,067 | 29 | 0.3% |

| 69 | Yuma, AZ | $283,300 | 32 | 3.8% |

| 70 | Columbia, MO | $283,000 | 30 | 2.0% |

| 71 | Rochester, MN | $271,400 | 23 | 0.4% |

| 72 | Springfield, IL | $157,083 | 6 | -0.6% |

| 73 | Birmingham-Hoover, AL | $211,000 | 20 | 1.1% |

| 74 | Cedar Rapids, IA | $198,850 | 24 | -0.1% |

| 75 | Evansville, IN-KY | $192,833 | 17 | 1.5% |

| 76 | Laredo, TX | $230,046 | 56 | -1.1% |

| 77 | Dothan, AL | $159,100 | 19 | 0.5% |

| 78 | Virginia Beach-Norfolk-Newport News, VA-NC | $303,250 | 26 | 1.2% |

| 79 | Charleston-North Charleston, SC | $410,667 | 17 | 3.1% |

| 80 | Ogden-Clearfield, UT | $441,274 | 21 | 3.0% |

| 81 | Flagstaff, AZ | $593,833 | 27 | 5.3% |

| 82 | Springfield, MO | $230,000 | 16 | 3.0% |

| 83 | Greenville, NC | $215,500 | 12 | 3.7% |

| 84 | St. Joseph, MO-KS | $161,667 | 15 | 0.6% |

| 85 | New Haven-Milford, CT | $307,817 | 8 | 4.0% |

| 86 | Bloomington, IN | $261,750 | 33 | 2.0% |

| 87 | Durham-Chapel Hill, NC | $371,083 | 12 | 3.7% |

| 88 | Salt Lake City, UT | $500,305 | 19 | 2.4% |

| 89 | Omaha-Council Bluffs, NE-IA | $265,436 | 9 | 1.9% |

| 90 | Cincinnati, OH-KY-IN | $237,300 | 7 | 2.2% |

| 91 | Dallas-Fort Worth-Arlington, TX | $371,677 | 23 | 1.3% |

| 92 | Wilmington, NC | $411,583 | 20 | 3.7% |

| 93 | Johnson City, TN | $226,160 | 13 | 4.1% |

| 94 | Pittsburgh, PA | $187,867 | 16 | -0.3% |

| 95 | Colorado Springs, CO | $426,000 | 26 | 0.9% |

| 96 | Manchester-Nashua, NH | $434,489 | 6 | 4.1% |

| 97 | St. Louis, MO-IL | $214,629 | 8 | 1.0% |

| 98 | Houston-The Woodlands-Sugar Land, TX | $314,083 | 30 | 0.2% |

| 99 | Davenport-Moline-Rock Island, IA-IL | $166,083 | 12 | -0.5% |

| 100 | Bakersfield, CA | $322,083 | 16 | 2.7% |

| 101 | Duluth, MN-WI | $208,596 | 16 | 2.3% |

| 102 | Kalamazoo-Portage, MI | $217,096 | 11 | 1.4% |

| 103 | Athens-Clarke County, GA | $323,333 | 19 | 4.2% |

| 104 | Detroit-Warren-Dearborn, MI | $216,667 | 12 | 1.0% |

| 105 | Spokane-Spokane Valley, WA | $361,667 | 23 | 2.6% |

| 106 | Fargo, ND-MN | $268,667 | 37 | -1.6% |

| 107 | Wichita, KS | $236,875 | 10 | 2.4% |

| 108 | Corpus Christi, TX | $263,733 | 40 | -1.2% |

| 109 | Racine, WI | $216,583 | 20 | 1.4% |

| 110 | Las Cruces, NM | $273,363 | 31 | 2.9% |

| 111 | Billings, MT | $402,171 | 30 | 1.8% |

| 112 | Gainesville, FL | $280,067 | 24 | 2.5% |

| 113 | Albuquerque, NM | $322,333 | 11 | 3.7% |

| 114 | Provo-Orem, UT | $481,333 | 22 | 2.1% |

| 115 | Reading, PA | $235,800 | 8 | 2.8% |

| 116 | Greensboro-High Point, NC | $230,083 | 14 | 2.8% |

| 117 | St. Cloud, MN | $252,133 | 27 | 1.2% |

| 118 | Kansas City, MO-KS | $275,833 | 8 | 1.8% |

| 119 | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | $304,490 | 11 | 1.6% |

| 120 | Beaumont-Port Arthur, TX | $194,792 | 42 | -3.3% |

| 121 | Waterloo-Cedar Falls, IA | $176,667 | 10 | 0.5% |

| 122 | St. George, UT | $490,680 | 37 | 2.6% |

| 123 | Kennewick-Richland, WA | $400,167 | 24 | 1.8% |

| 124 | Allentown-Bethlehem-Easton, PA-NJ | $277,983 | 11 | 2.9% |

| 125 | Boise City, ID | $448,317 | 16 | 3.7% |

| 126 | Richmond, VA | $331,942 | 8 | 2.2% |

| 127 | Baton Rouge, LA | $223,233 | 32 | -1.9% |

| 128 | Lexington-Fayette, KY | $278,417 | 10 | 2.2% |

| 129 | Chicago-Naperville-Elgin, IL-IN-WI | $286,500 | 12 | 0.4% |

| 130 | Minneapolis-St. Paul-Bloomington, MN-WI | $328,333 | 25 | -1.0% |

| 131 | Seattle-Tacoma-Bellevue, WA | $641,667 | 7 | 1.7% |

| 132 | Louisville/Jefferson County, KY-IN | $233,667 | 12 | 0.4% |

| 133 | Lynchburg, VA | $233,150 | 16 | 2.6% |

| 134 | Las Vegas-Henderson-Paradise, NV | $404,967 | 19 | 1.7% |

| 135 | Portland-South Portland, ME | $475,000 | 11 | 4.1% |

| 136 | Tucson, AZ | $333,333 | 21 | 2.9% |

| 137 | Asheville, NC | $402,000 | 28 | 2.5% |

| 138 | Madison, WI | $351,333 | 9 | 1.7% |

| 139 | Lake Charles, LA | $199,000 | 60 | -6.6% |

| 140 | Winston-Salem, NC | $240,000 | 12 | 2.9% |

| 141 | Champaign-Urbana, IL | $176,500 | 11 | -0.3% |

| 142 | Denver-Aurora-Lakewood, CO | $542,933 | 12 | 0.1% |

| 143 | Bismarck, ND | $284,964 | 33 | -1.6% |

| 144 | Bloomington, IL | $197,067 | 4 | 0.9% |

| 145 | Roanoke, VA | $247,333 | 11 | 3.0% |

| 146 | Jackson, MS | $203,491 | 23 | -0.4% |

| 147 | Fresno, CA | $368,333 | 15 | 1.6% |

| 148 | Lincoln, NE | $251,167 | 15 | 0.8% |

| 149 | Riverside-San Bernardino-Ontario, CA | $533,333 | 21 | 2.0% |

| 150 | Wichita, KS | $286,417 | 16 | 1.8% |

| 151 | Greeley, CO | $455,317 | 19 | -0.6% |

| 152 | Rapid City, SD | $341,917 | 17 | 2.7% |

| 153 | Yakima, WA | $333,833 | 23 | 2.0% |

| 154 | Tallahassee, FL | $257,267 | 18 | 1.7% |

| 155 | Worcester, MA-CT | $381,000 | 9 | 2.8% |

| 156 | Providence-Warwick, RI-MA | $404,900 | 11 | 2.7% |

| 157 | Lafayette-West Lafayette, IN | $237,483 | 8 | 3.1% |

| 158 | Merced, CA | $386,667 | 18 | 1.9% |

| 159 | Salem, OR | $417,842 | 25 | 0.7% |

| 160 | Midland, TX | $329,167 | 21 | -3.3% |

| 161 | Albany-Schenectady-Troy, NY | $291,958 | 11 | 1.0% |

| 162 | College Station-Bryan, TX | $282,667 | 26 | -0.7% |

| 163 | Bridgeport-Stamford-Norwalk, CT | $514,167 | 10 | 3.4% |

| 164 | New Orleans-Metairie, LA | $238,333 | 42 | -4.2% |

| 165 | Iowa City, IA | $277,667 | 19 | -1.2% |

| 166 | Portland-Vancouver-Hillsboro, OR-WA | $505,333 | 20 | -0.5% |

| 167 | Baltimore-Columbia-Towson, MD | $323,900 | 9 | -0.4% |

| 168 | Reno, NV | $515,483 | 20 | 0.7% |

| 169 | New York-Newark-Jersey City, NY-NJ-PA | $569,000 | 30 | 0.0% |

| 170 | Tuscaloosa, AL | $240,317 | 15 | 0.3% |

| 171 | Yuba City, CA | $392,967 | 18 | 1.0% |

| 172 | Modesto, CA | $440,667 | 12 | 1.4% |

| 173 | Shreveport-Bossier City, LA | $190,150 | 32 | -3.4% |

| 174 | Ames, IA | $234,400 | 19 | -0.8% |

| 175 | Washington-Arlington-Alexandria, DC-VA-MD-WV | $491,667 | 7 | -0.1% |

| 176 | Springfield, MA | $296,667 | 10 | 1.7% |

| 177 | Bellingham, WA | $555,667 | 17 | 1.7% |

| 178 | Fort Collins, CO | $521,146 | 19 | -0.1% |

| 179 | Boston-Cambridge-Newton, MA-NH | $608,333 | 8 | 1.5% |

| 180 | Santa Fe, NM | $555,000 | 30 | 2.3% |

| 181 | Redding, CA | $373,752 | 29 | -0.2% |

| 182 | Santa Maria-Santa Barbara, CA | $852,250 | 12 | 3.9% |

| 183 | Los Angeles-Long Beach-Anaheim, CA | $886,667 | 15 | 1.2% |

| 184 | Ann Arbor, MI | $343,833 | 8 | -0.3% |

| 185 | Salinas, CA | $821,000 | 17 | 1.6% |

| 186 | Boulder, CO | $666,583 | 21 | -0.3% |

| 187 | Medford, OR | $417,000 | 25 | -1.1% |

| 188 | Lafayette, LA | $207,750 | 28 | -4.1% |

| 189 | San Jose-Sunnyvale-Santa Clara, CA | $1,386,667 | 9 | -0.7% |

| 190 | Oxnard-Thousand Oaks-Ventura, CA | $812,417 | 12 | 0.8% |

| 191 | Chico, CA | $368,583 | 20 | -2.1% |

| 192 | Napa, CA | $875,000 | 28 | -0.8% |

讨论

已经买房和准备买房的小伙伴们,欢迎在评论区分享一下当地的房市情况呀~

数据来源:SmartAsset,封面图Credit:Shutterstock

最新评论 11

:我在Salinas,这里老墨多华人少,离海边近气温很凉爽,就是吃不到什么好吃的中餐![[捂脸哭]](/assets/emoji/comment-emoji/dm_wulianku@2x.png?v=1) 想要喝杯正宗一点的奶茶需要跑到San Jose

想要喝杯正宗一点的奶茶需要跑到San Jose![[叹气]](/assets/emoji/comment-emoji/dm_tanqi@2x.png?v=1)

:我在San Jose,笑而不语![[狗头]](/assets/emoji/comment-emoji/dm_goutou@2x.png?v=1)

:Lawton ok狗都不去

:来拉斯维加斯

:千万别参考这个表,Rochester 可是这两年纽约州房价涨幅最高的城市。这个表显示中位数$199,975,疫情前还行,现在这个价买到的大概是前不着村后不着店100年以上的小破旧吧![[笑哭]](/assets/emoji/comment-emoji/dm_xiaoku@2x.png?v=1)

:我都不明白这个城市房子为什么这么贵,冬天那么长,地税那么贵,要不是工作在这里,真不愿意在这里买房,去年买的,加价就算了,还没什么房子。

:这表看看就好,好几个地方我出差去过,简直穷山恶水,鸟不拉屎,华人搬家去这些地方不如回国去三线城市定居

:住个75年等于付了两次房价,每年地税乘以75,还不包括每年的房屋保险

:实际买房还要加价

:这哪里来的数据,太不准确了,他这中位数价格比真实数据差一半还少

:我们这边2400sq的两层独立屋,新房都在50万以上了